Snap. Tap. Deposit.

Want to skip your trip to the bank? With our Mobile Deposit feature, you can easily, safely, and securely deposit checks into your American Bank checking or savings account. Mobile Deposit can be used 24 hours a day, 7 days a week, and from virtually anywhere, using your mobile device’s camera.

Simply snap a photo of the front and back of your check, enter the amount and with a few taps, you’re done!

Watch a short video on how easy it is to use American Bank BD Mobile

For full details, please refer to the Mobile Deposit Terms & Conditions.

Start Using Mobile Deposit

In order to take advantage of Mobile Deposit, you’ll need to access Mobile Banking.

Download the Mobile Banking app:

Google Play

Apple App Store

Mobile Deposit FAQ

How does Mobile Deposit work?

It’s simple to deposit checks with Mobile Deposit. Using our Mobile Banking app, follow these easy steps:

- After logging in to Mobile Banking, tap the “Deposit” tab and select “Deposit Check.”

- Select the account into which you wish to deposit your check and enter the check amount.

- Photograph both sides of your endorsed check with your smartphone or tablet camera.

- Review your deposit information and then submit your deposit.

- View the status of your deposit in “Deposit Check History.”

Note: Be sure to keep the check until it posts to your account, then destroy it.

What are the eligibility requirements for using Mobile Deposit?

In order to use Mobile Deposit, you must have a checking account, saving account or Money Market account at American Bank, be enrolled in Online Banking, and have downloaded the American Bank Mobile Banking app on your smartphone or tablet. If you meet these criteria, you may begin using Mobile Deposit by accepting the Mobile Deposit Service Agreement the first time you access Mobile Deposit on your smartphone or tablet.

Are there any fees associated with using Mobile Deposit?

No, there are no fees charged for using Mobile Deposit. We recommend you check with your service provider for any wireless carrier fees.

How do I access Mobile Deposit?

Mobile Deposit is a feature included in our Mobile Banking app. Within the app, tap the “Deposit” tab to access Mobile Deposit.

What is the dollar limit for mobile deposits?

American Bank's standard limits for mobile deposits are based on a deposit risk management system that will affect the amount that can be deposited via mobile deposit.

If a customer tries to deposit a check that is above their limit, they will be notified in the app immediately, and instructed to bring the check into a branch to deposit. The goal of this feature is to better serve customers based on their banking history, accept more checks on the first attempt, as well as protecting them from any potentially fraudulent checks.

What types of checks can I deposit?

Personal, business and government checks payable in U.S. dollars, drawn on a U.S. bank and payable to you can be deposited. Checks that cannot be deposited using Mobile Deposit include:

- Money orders

- Charge card convenience checks

- U.S. savings bonds

- Checks that are payable to another person other than the deposit account owner (e.g. third-party checks)

- Foreign checks and those payable in a foreign currency

- Altered checks

- Checks more than six (6) months old

- Checks that were previously deposited

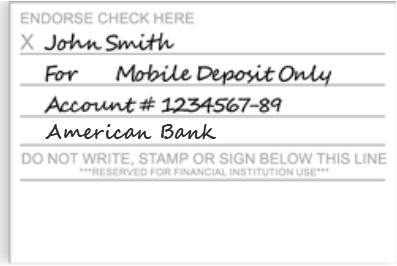

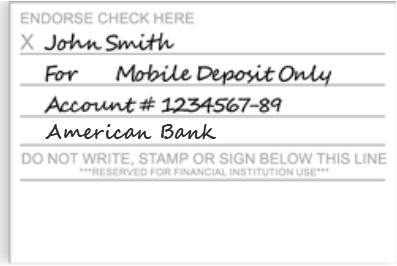

How do I endorse my checks for Mobile Deposit?

When endorsing a check for mobile deposit, you will want to do it the same as though you were presenting it to a Customer Service Representative at any of American Bank's full-service locations, making sure to sign your name in the designated area on the back. In addition to your signature, you will also want to add this verbiage to the back of your check 'For mobile deposit only, American Bank, Account # {your account number}'

For business customers, you will want to endorse the checks as you usually would for the business (usually the business name) and then follow the same additional verbiage 'For mobile deposit only, American Bank, Account # {business account number}'

If your check is not endorsed in this manner, it may be declined.

How will I know the status of my deposit?

You can check the status of your deposit by tapping “Deposit Check History” in Mobile Deposit. The system will indicate whether the deposit has been accepted, rejected or is pending.

When will my deposits be available?

Mobile deposits are reviewed multiple times per day during normal business hours. If your mobile deposit was made during business hours, you will see the check in your account by the end of the current business day. In most cases it will be available no later than the following business day.

How long should I keep a check after I mobile deposit it?

We recommend that you should keep any checks that you've deposited via American Bank BD Mobile for a minimum of 14 days after depositing it. After this time period, you should securely destroy the check (i.e., shred it) and not just throw it out.

Can I deposit more than one check at a time?

You can deposit multiple checks in the same Mobile Deposit session; however, you may only photograph and submit one check at a time.

How can I ensure that the check images I take will be high quality?

To ensure a high-quality check image, your smartphone or tablet must have a built-in camera that’s at least 2-megapixels. When capturing the image, please:

- Place check on flat, dark-colored surface in a well-lit area.

- Position device’s camera over check to minimize angles, glare and shadows.

- Align the check with the four corners of the guide image, not the corners of your screen.

- Avoid objects and clutter around the check.

- Hold the device steady.

You have the option to retake photographs of the check before submitting, or you may cancel the deposit. The system will notify you if the image is unclear for processing. If you are unable to photograph a clear image, please bring your deposit to one of our branches for processing.

Are check images saved on my device?

Check images are never saved on your smartphone or tablet. The images are securely transmitted and digitally stored at the bank in accordance with the Check 21 Act, which allows financial institutions to process checks electronically.

What if I submit the same deposit twice in error?

If the same check is submitted for deposit twice, it will be identified and stopped by the Mobile Deposit system. Should this occur, you will receive a declined deposit notification for the second deposit of the check.

Can I make payments with Mobile Deposit?

You can’t use Mobile Deposit to make payments to your loans. However, if you’d like to make these payments electronically, you can use the convenient Transfer or Bill Pay features of Mobile Banking.

Quick Links

Online Banking

Mobile Banking

eStatements

Online Billpay