Electronic Services Questions

How can I reset my online banking security questions?

To reset your security questions in American Bank's online banking, you can do one of two options:

- You can log-in to your online banking account and go to your profile (upper right corner of the page), and then choose challenge questions to change your security questions and/or your answers to the existing ones.

- You can also call one of our full-service locations and a Customer Service Representative can clear your questions and help you reset them.

I can't log into my online banking account...

If you find yourself in a situation like this, please call one of American Bank's full-service offices for assistance. There is a chance that you have been locked out of your online account, for a variety of reasons (including too many log-in attempts with incorrect credentials). In these situations, you will need to call a Customer Service Representative to be reset in online banking. This is for security purposes so we can verify that it is indeed you trying to access your accounts.

Can I nickname my accounts online?

Yes! All consumer customers have to do is log-in to your online banking account with American Bank, on the accounts page, you can click edit. Here a text box will come up with the default name of the account. You can highlight this text and change it to whatever you'd like it to be and then click the save button. You can also rearrange the order of how accounts appear on your accounts page - just use the move arrows.

Business customers, you can also put nicknames on your online accounts. If you'd like to do that, please call any of the bank's full-service offices to make that request and we will be happy to assist you.

How do I hide my accounts in online banking?

You will need to login to Retail Online on your desktop. Once in, click on 'Edit Accounts' at the top of the account list. Then simply uncheck the box of the account you wish to hide.

If you wish to hide your accounts in the mobile app as well, you will need to be logged into the desktop version of Retail Online. Once logged in, select 'Profile' then click on 'Manage Devices' next to Mobiliti. You will then select 'Accounts' tab on the redirected page. Uncheck the boxes of the accounts you wish to hide. Once this is complete, hidden accounts will not be seen in the mobile app.

How can I transfer to another account in online banking?

After you log-in to your online banking account from American Bank, click on the Transfer button in the blue bar in the middle of the page. On the next screen you will choose which account you want to transfer from, account you want to transfer to, the date you want the transfer made, amount of transfer and an optional description if you want to enter something as a note to yourself. When you're done, click Preview Transfer. On this screen you will see the information you entered previously; review it. If it looks good, then click Complete Transfer. Otherwise, click edit or cancel.

You can also make a transfer from American Bank BD Mobile - our mobile friendly banking app. Just log-in to your app, then tap on the Transfer & Pay tab, then click Make an internal transfer. You can choose which account the funds will come from, where they will go and the amount. Then tap continue. You can review your information on the next screen before clicking Complete Transfer or edit. Please note that with this method, funds will be transferred at the earliest opportunity.

How can I view pending transfers and/or payments through online banking?

Pending transfers and payments will show in your account history. From online banking, select the account you would like to view from the home screen or Accounts tab. A yellow clock will display next to pending transactions or a blue calendar symbol will appear next to scheduled items.

In American Bank BD Mobile, after you log-in, you will want to tap the Transfer & Pay tab. From there, click Payment Activity. Here you will see a list of pending payments.

Is there a fee to transfer funds between accounts at American Bank?

There is no fee to transfer funds between accounts at American Bank through online or mobile banking.

How can I see an image of checks that I have deposited?

From online banking, after you log-in, from the Home screen, choose your account that the check was deposited into. In the Description line, it will say Deposit and it will be highlighted red. Click this link. You will then be able to see an image of the deposited check.

From American Bank BD Mobile, after logging in, on the accounts screen, choose your account that had the deposit. Then if there is a Deposit in the description, there should also be a View Check link under the amount of the deposit. If you click this, you will be able to see an image of the check.

How do I view an electronic image of a check I wrote?

From online banking, after you log-in, from the Home screen, choose your account that the check was written from. In the Description line, it will say Check {number of the check written} and it will be highlighted red. Click this link. You will then be able to see an image of the returned check.

From American Bank BD Mobile, after logging in, on the accounts screen, choose your account that the check was written from. In the Description line, it will say check and provide the check number, there should also be a View Check link under the amount of the check. If you click this, you will be able to see an image of the check.

My Bill Payment was not withdrawn from my account or received by the payee, what do I do?

If you have one of these situations, please contact a Customer Service Representative at any of American Bank's full-service offices for assistance.

How long will my statements remain in Online Banking? How do I view an old one?

eStatements remain accessible in Online Banking for two years.

To view an eStatement, log-in to online banking and follow these steps:

- Select the account you wish to view statements for

- Click the Documents tab

- On the next screen, eStatements should be the default, if not, choose document type from drop down menu

- Enter the date range and click Submit

- Then you can choose which month (or months) statement(s) you wish to view

If I'm traveling out of the country, can I access Online Banking? American Bank BD Mobile?

American Bank does not block access if you are out of the country. Please contact your mobile phone/Internet provider for questions on coverage outside of the United States.

However, please remember if you plan to use your debit card while out of the country, you will need to contact a Customer Service Representative to have your destination country unblocked - by default, all American Bank debit cards are blocked for foreign transactions for your protection.

Deposit-Related Services

Can I mail a check for deposit into my account?

Yes, you can mail a check for deposit to:

American Bank

PO Box 438

Beaver Dam, WI 53916

You can also deposit checks by using the mobile deposit feature of American Bank BD Mobile. To learn more about our mobile banking app, visit our mobile banking page.

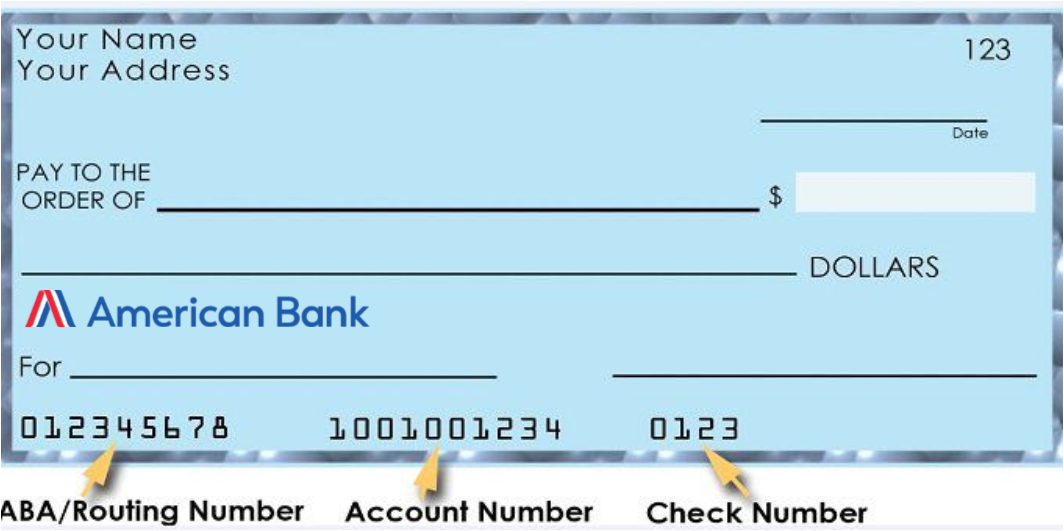

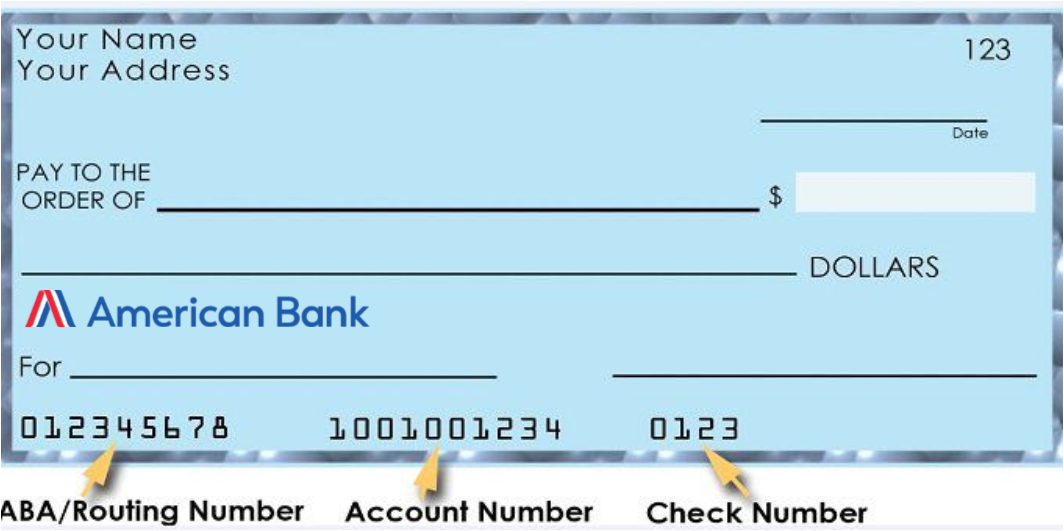

Where can I find my account number?

You can locate your checking account number on the bottom of your check, your account number will be the middle grouping of numbers on the check.

If you have another account, or don't have checks for your checking account, you can call us or stop in and visit us at any of our offices to get that information (after we've verified it's you for security purposes). Please note, that for those same security reasons, we will not be able to provide account numbers via email or other electronic communications (i.e., chat).

How do I transfer money into another account at American Bank?

You can do a transfer between accounts at American Bank a few different ways:

- mobile banking

- online banking

- 24-hour bank by phone

OR

- call a Personal Banker at any of our offices

To transfer via online banking, follow these simple steps:

- Log in to online banking

- Click the Transfers Tab

How do I send or receive wire transfers?

If you are sending a wire transfer from your account, you will need to obtain the beneficiary's incoming wiring instructions. You can then call, email or fax us the information. All wires will be verified with a phone call to the phone number we have on file for validation. There is a $25 fee to send a wire within the United States and a $50 fee for wiring funds internationally.

To receive a wire in US currency, send wire to Bankers Bank, Madison, WI, routing number 075912479, for credit to American Bank, routing number 075901516, for further credit to {your name, address and account number}.

If you are receiving a wire in foreign currency, you must call American Bank's Deposit Operations Department at 920.885.2700 during normal business hours (Monday through Friday, 8 am to 5 pm) for specific wiring instructions. All incoming wires to American Bank (whether foreign or domestic) have a $15 fee associated with them.

Please note that there is a cutoff time of 2:30 pm for foreign wires and 3 pm for wires within the United States; wires can only be completed Monday through Friday on days that the bank is open.

How do I change my name, address, email or other contact information?

To update your address, email or other contact information you can either,

OR

- log-in to online banking, select the profile section (tab is located in the upper right corner of the page in the red bar) and choose which field you would like to change

If you need to complete a name change, you will need to stop into one of our full service offices and see a Customer Service Representative.

Do you offer foreign currency ordering or exchanging? Is there a fee?

At American Bank, we offer ordering of foreign currency. Please note, there is a $20 fee for this service, plus the exchange rate.

For more information call or stop in one of our full service locations.

Please remember if you are planning to travel outside of the United States and want to use your debit card while out of the country, you will need to contact a Customer Service Representative to have your card unblocked for your destination country. For your protection, by default, American Bank's debit cards are blocked from being used for international transactions.

What's the difference between a debit card and an ATM card?

American Bank debit cards allow you to make purchases at point-of-sale merchants anywhere Visa is accepted, as well as the ability to withdraw cash at ATMs or point-of-sale terminals where merchants allow you to get back cash over and above the purchase price of your transaction. The money is then deducted from your checking account, just as though you had written a check for that amount.

Automatic Teller Machine (ATM) cards can only be used at an ATM terminal to withdraw cash or certain merchants that accept ATM transactions - but these are rare.

To learn more about American Bank's debit cards and the benefits available by using one, visit our debit cards and ATMs page.

All American Bank checking accounts come with a no-fee debit card. To view our line-up of checking account options, visit our personal checking page.

Why are my debit card transactions being denied?

If your American Bank debit card is being denied, there could be a variety of reasons. Some of those include non-sufficient funds (NSFs), attempting to make a purchase outside the United States (either online or in-person if you are traveling), attempting to use an incorrect PIN and many more. If you continue to experience a denial of service with your debit card, it is recommended to call a Customer Service Representative at one of our full-service locations, or stop in and see us during normal business hours.

What is a pre-authorization on a debit card?

A pre-authorization occurs when a merchant puts a 'hold' on the funds they are requesting until they can complete the process of the transaction. Many times, this will happen at places like gas pumps, hotels and airlines, but can realistically happen with any type of merchant. These 'holds' generally fall-off / disappear after a few days. If it has been more than five days and pre-authorization is still on your account, please call a Deposit Operations Specialist at 920.885.2700.

I am out of town and debit card won't work. I know there are funds in the account, what should I do?

If you find yourself in a situation like this, it is best to call a Customer Service Representative at one of our full-service offices. You can also email us at banking@americanbankbd.com or log-in to online banking and securely message us and/or open a chat with one of our banking specialists.

If you are traveling and did not let the bank know of your plans, the card could very well be blocked due to security parameters put in place to protect your finances. To get your card opened for purchases outside of your usual spending area, be sure to contact us prior to your travels - this can help prevent some of these situations by placing an alert in your account and making your funds more available to you.

How do I stop a recurring payment on my debit card?

The best way to stop a recurring payment on your debit card is to contact the company that is charging your account directly and asking them to stop the recurring payment. We can do it for you at American Bank, but there is a $25 fee to do so AND we cannot stop a payment that is already hit your account, we can only stop future ones from pulling. If you need our assistance in stopping a recurring debit card payment, please contact a Deposit Operations Specialist at 920.882.2700.

What do I do if I suspect a transaction on my card is fraudulent?

If you come across one of these charges during normal business hours, you should call us immediately at one of our full-service locations. If it is after normal banking hours, please call 1.800.472.3272 as soon as possible. With either method, your card will be closed immediately to help protect the funds in your account. Then you will need to stop in to one of our full-service offices during bank hours to fill out a debit card dispute form.

How do I add travel notes to my debit card? What do I do if I will be traveling?

If you are planning a trip, please contact a Customer Service Representative at any of our full-service offices so he or she can enter a travel alert in your account.

Does my debit card have transaction limits? Does this differ depending on whether I use an ATM or at the point of sale at a merchant?

Yes, American Bank debit cards have separate daily transaction limits for both ATM cash withdrawals and point of sale purchases at merchants / stores. If you have reached your daily limits in one category, you will have to wait until the next day to try that same type of transaction.

For security purposes, we are not disclosing what those individual daily limits are, but if you'd like to inquire, you can call contact any of our full service offices.

Additionally, these limits can be increased - with approval from management - either temporarily or ongoing. If you would like to request a transaction limit increase, please contact a Deposit Operations Specialist at 920.885.2700.

I am receiving a 'bad pin' error message at the ATM, what does this mean?

If you receive a 'bad pin' message you are likely entering an incorrect PIN number. If you need to reset your PIN, you can do so by calling 1.800.992.3808.

What do I do if the ATM does not dispense the money I asked for and the funds have been deducted from my account?

If you are an American Bank customer, you will need to stop into one of our full service offices and fill out an ATM dispute form. If you are a customer of a different financial institution using an American Bank ATM, you will need to contact your institution and follow its procedures.

What are the service fees for ATM withdrawals?

If you use an American Bank ATM terminal or any participating MoneyPass Network ATM, there are no fees. If you are using another network ATM, those terminals will display the fee (if they charge one) prior to you authorizing the transaction.

Where are American Bank's ATMs located?

Currently, American Bank has a 24-hour drive-up ATM at our Spring St. Office on Beaver Dam's Northside (1519 N. Spring St., across the street from Beaver Dam Culvers), a 24-hour walk-up ATM with deposit capabilities at our Front St. Office (115 Front Street) and one at our Office inside Beaver Dam Walmart (120 Frances Lane), which is available 24 hours a day.

How do I sign up for direct deposit?

To sign up for direct deposit, all you have to do is give your employer, social security, etc. American Bank's routing number (075901516) and your account number. Some employers also like you to provide them with a copy of a voided check. You should check with your employer, social security, etc. for their specific requirements.

If you need assistance, there is a section within American Bank's Switch Kit that outlines how to change direct deposit to an account American Bank when you open a new account with us. Please feel free to use this as a reference as well. Get your copy of American Bank's Switch Kit. And, as always, if you need assistance with anything, please feel free to contact your nearest office.

How do I get a copy of canceled or cleared check?

Within online banking, you can print a copy of any returned check image. These images are also included on monthly bank statements from American Bank. If you need additional information, or cannot access the check you are looking for, you can always call a Customer Service Representative at any of our full-service offices for assistance.

How do I dispute a charge on my account?

You have 60 days from the date of the transaction to dispute any charge on your account. Depending on how the charge was processed (ACH, debit card, check, etc.), you may need to stop in and fill out corresponding dispute forms. If it is a check, American Bank can take care of most of those over the phone. The best thing to do to get the ball rolling is to call a Customer Service Representative so we can get details from you and figure out the best next steps.

If you feel the disputed charge is a result of fraud, and especially fraud on your debit card, be sure to call us at any of our full service offices during normal business hours, or 1.800.472.3272 if it's after banking hours to close your card and help protect remaining finances in your account.

What is the difference between current balance and available balance?

Current balance is the balance at the close of the previous business day. Available balance is the balance as of that specific time of the day as items are being put through your account, including pending transactions and holds being subtracted from your account balance. Available balance is what we use for accessible purchases and withdrawals. Available balance does not include checks which have not been cashed or any deposits that have not yet posted.

If you need further clarification on the difference between your current balance and your available balance, please feel free to call a Deposit Operations Specialist at 920.885.2700 between 8 am and 5 pm, Monday through Friday.

How much will it cost to put a stop payment on a check?

American Bank currently charges $30 to put a stop payment on a check.

To request a stop payment, please contact a Customer Service Representative at any of our full service offices and he or she will be happy to assist you.

Why did I receive a call from fraud prevention?

If you received a call from our fraud prevention service, that means there was questionable activity on your debit card that through some algorithms our fraud detection service felt were at high risks.

You can also sign up with a Customer Service Representative at any of our full-service locations to receive these types of messages via text. If you wish to do that, just call our office nearest you and we can get you signed up right away!

As a reminder, to help prevent legitimate transactions from being flagged, please let us know when you will be traveling so we can put an alert on your card, and in some cases, we will need to open it up to be used in certain areas.

How do I get a copy of a statement?

If you are signed up for American Bank's Online Banking service, you can pull a statement from as far back as two years. To access statements via online banking,

If you need a statement from a time period older than that, or you do not have access to our online banking system, you can call a Customer Service Representative at any of our full-service offices and we can get you a copy - in most cases - either via mail or you can stop in and pick it up at your closest office. Please note, that if we do need to print a copy for you, there is a $2 fee per page for printing statements.

Do you send out year-end statements?

At American Bank, we send out checking account statements monthly - either a notification comes to your inbox that your eStatement is available or you get a paper copy in the mail. Savings account statements are sent out quarterly and at year-end (unless there are electronic payments that come from the account, then statements are sent monthly). Individual Retirement Accounts (IRAs) get a Fair Market Value statement that goes through the end of the calendar year; many times, these statements will be sent out in January for the previous year.

Additionally, American Bank provides 1099 and 1098 forms for accounts that qualify each January. A copy of these forms can be found within Online Banking.

I have a direct deposit coming in the same day as my automatic loan payment. What will be processed first?

At American Bank, when your account posts for the day, deposits are always processed before anything being withdrawn from your account.

How do I put a stop payment on a check?

If you need to put a stop payment on a check, you can contact a Customer Service Representative at any of our full-service offices and he or she will be able to assist you.

If you have access to our American Bank's Online Banking system, you can also enter a stop payment request through online banking.

Please note that there is a $30 fee for placing a stop payment on a check.

How long does it take to verify a deposit?

Most checks deposited can deemed good three to five business days from when it was deposited. If we have any concerns about the validity of the check, we will place a hold on the check - which will give the check time to 'clear' / be verified as legit before disbursing funds to you. This is for your protection as much as it is for the bank's protection - if we provide you with the funds before they are verified and they come back as fraudulent, you are responsible for returning those funds.

Where can I send / fax a verification of deposit request?

Verification of deposits can be emailed to accounting@americanbankbd.com or faxed to American Bank's Deposit Operations Department at 1.920.885.2709.

How do I set up an automatic withdrawal?

You can set up automatic withdrawals one of two ways:

- If you have online and/or mobile banking with American Bank, you can log-in and use our Online BillPay services.

In Online Banking

1. After logging in, click Bill Payment at the top of the screen

2. Then click Payment Center

3. Then click Add a Company or Person in the middle of the screen (grey button)

4. On the next screen select the type of company to pay

5. Now, enter the company contact information (name, your account number with them, mailing address, phone and email)

6. On the next screen, click Finish

7. Then go down your list of billers and find the one you just added, enter amount you wish to pay in the appropriate box and choose which date you want the payment delivered

8. Then click the link below that information that says AutoPay

9. Click Set Up AutoPay

10. You can choose the amount, first delivery date, frequency, duration and email preferences (would you like to be emailed when the payment is pending, being sent and/or before sending the last payment), then click Start Sending Payments

11. The next screen is a confirmation page; you can either close or print for your records

12. That's it! You've successfully set up an automatic recurring payment. You can always view pending payments by clicking the Activity link within each biller and/or on the side of the screen under 'Recent Payments.'

On Mobile Banking

1. After logging in, tap the Transfer & Pay tab at the top of the screen

2. Then, tap Pay my contacts

3. In this screen, click the green plus sign 'Add new contact'

4. Then click Add Manually

5. On the next screen add the name of the company you wish to pay, then tap Next

6. Then choose if it's a person or company you wish to pay,

7. Next enter account information and click Next

8. On this screen enter mailing address and phone information from your invoice, tap Next

9. On the next screen you will get confirmation and then you can click Pay

10. You have the option to choose which account the funds come from, how much to pay and what date to deliver it on the next screen; enter this information the tap Pay

11. On the next screen you receive a confirmation of the payment. In the lower left you have an option to set Autopay; tap this tile

12. Here you choose which account, duration (for a specific number of payments, until a certain date or you manually end the recurring payment), amount for each payment, next delivery date and frequency of payments. Enter all that information and the tap Review.

13. Review the information and if everything is correct, tap Save.

14. That's it! Now you have a confirmation of the recurring payment you just set up. To review your recurring payments, you can go into Transfer & Pay tab and then tap payment activity, a list of pending and past payments will be listed here.

- The second way is to visit any of our full-service offices and ask to fill out an automatic transfer withdrawal form. If you choose to go this route, we will need a signed form on file.

How do I stop an automatic withdrawal / payment?

It depends on how you set up the automatic withdrawal / payment to start with.

- If you set it up in Online Banking, here is what you'd need to do:

1. Log-in to your online banking account

2. Click Bill Payment tab at the top of the screen

3. Then find the automatic biller in your list under the Payment Center

4. Click the Activity link within that particular biller

5. Then click More Activity link

6. Click the payment information and from this screen click the Cancel link

7. From here you can cancel this payment only or you can Stop AutoPay Series

8. On the next screen you will need to confirm to stop payment by clicking Stop AutoPay

9. You can then click Close on the next screen

10. You can then go back to the Payment Center and look in the Recent Payments section on the right

hand side to verify that the payment has been canceled

- If you want to cancel in your Mobile Banking app, here is what you should do:

1. Log-in to your mobile app

2. Then click the Transfer & Pay tab at the top of the screen

3. Tap Payment activity

4. From this screen, find the pending payment you wish to stop and tap on it for more details

5. From here, you can click Cancel Payment

6. If this is a recurring payment, you will need to do steps four and five for each occurrence

7. When you go back to the Payment Activity screen you can see which payments are pending, canceled

and paid to verify if you've canceled all occurrences.

- If you set up the transfer by visiting one of our offices and signing a form, we will need you to contact us to get and sign a termination form.

What is an IBAN? How do I use one?

IBAN stands for International Bank Account Number. We typically see them used when wiring money internationally.

Consumer Deposit Questions

What is a postdated check?

A post-dated check is a check that is dated for a future date, not the current date. For example: Let's say the date today is March 25 and your rent is due on the first of each month so you date your rent check for April 1 before you give it to the landlord with the intent he or she will not cash it until the first of the month. Banks generally try to honor the date on the check; however, we are not required to do so. With today's electronic processing if the landlord's bank takes the check for the deposit prior to the first of the month, it may clear your account prior to the first.

Are there a minimum number of deposits I have to make into a checking/savings account monthly?

No, American Bank does not require you to make any certain number of deposits per month. You do, however, need to maintain a positive balance in your account to keep the account in good standing with the bank.

Do you charge for cashier's checks?

Yes, American Bank charges a $3 fee per cashier's check.

Do you offer notary services? Do you charge?

Yes, American Bank has several Notaries at our full-service offices. We do not charge customers or non-customers for this service.

Please note, you should bring a photo ID with you. If your document requires a witness signature, we can provide someone at the bank to do that as well or you can bring a witness with you.

Do you offer safety deposit boxes?

Yes, American Bank offers safety deposit boxes at two of our offices in Beaver Dam (Front Street and Spring Street locations) as well as at our office in Necedah. Boxes come in several sizes and rented on an annual basis. Rates are very reasonable and vary by box size. Contact a Customer Service Representative at any of these locations for more information and someone will be happy to assist you.

What do I need to open a club or association account?

American Bank is proud of our commitment to our community and we do not charge monthly service fees to local charities that bank with us. You will need an EIN number and identifying information for all individuals who will be signing on the account. We are also required to collect additional information from your control person. Please contact a Personal Banker at one of our full-service offices to learn more.

Do you offer accounts for students?

To open an account at American Bank, you need to be 18 years of age or older, or have a parent/guardian as a co-owner / co-signer on the account. We offer two types of checking accounts - interest bearing checking (designed for customers who carry larger balances) and Carefree checking (no-monthly service fees and no limit on the number of transactions you can do). Contact a Personal Banker at any of our full-service offices to learn more about the accounts we offer and which one may be a good fit for you.

Can a minor have a checking account with a debit card?

To open an account at American Bank, you need to be 18 years of age or older, or have a parent/guardian as a co-owner / co-signer on the account. If a parent wishes to co-sign, agrees to assume liability and signs the debit card application, we will issue a debit card to a minor.

What will I need to open a deposit account?

All new customers to American Bank are required, by law, to provide a valid, unexpired, government issued photo ID. You will also need your social security number, telephone number and proof of address if the address on your identification isn't current. You will also need the minimum opening deposits required to fund the account, $25 for savings accounts and $50 checking accounts.

How do I open an account at American Bank?

There are a variety of ways you can open a deposit account with American Bank, including:

How do I fund a new account?

American Bank accepts either cash or check to open a new account. When a check is used to open a new account, funds may not be made available for immediate use. We can also do a cash advance on a credit card to fund your new account.

Can I order checks from any company or does it have to be through the bank's vendor?

American Bank encourages customers to order checks from wherever they feel the most comfortable - either through the bank's vendor, Checks for Less, or from a third-party vendor of your choice. Please note that if you choose to order from a third-party vendor, it will be your responsibility to ensure this vendor has the correct information (routing number, account number, bank information, etc.). The bank has the right to refuse checks that are not printed or formatted properly. If you have any questions, please contact a Customer Service Representative at any of our full-service offices and someone will be happy to assist you.

If I order from the bank's vendor, how long does it typically take to receive my check order?

With our relationship with Checks for Less, American Bank customers typically receive their check order in less than a week.

Do you offer overdraft protection?

American Bank offers two types of overdraft protection:

- Savings account transfer - You may authorize us to transfer funds from your savings account to your checking account in the amount of the overdraft plus a $10 fee.

- Line of credit - You can also apply for a line of credit. This is subject to credit approval and has a $20 annual fee. Balances used this way are charged interest daily.

Can I add someone to my account?

Yes, you may add additional signers / account holders to a deposit account with American Bank anytime you wish to. A new signature card will need to signed by all current account holders. If any of the new account holders are not currently customers at American Bank, he/she/they will need to provide proper identification, including a valid, unexpired, government-issued photo ID, social security number, telephone number and proof of address if it is different than the address on the identification card.

How do I remove someone from an account?

The only two instances when American Bank accountholders can remove a co-signer / co-owner of an account is at the death of an account holder or when an account has been owned by a minor and his/her parent(s) and that minor is now 18 years of age or older - provided that both parent and child agree to the parent being removed. In all other circumstances the account must be closed and a new account opened if you wish to remove a name from an account.

Do you offer Medallion Signature Guarantee services?

Yes, Medallion Signature Guarantee services are available to customers of American Bank at no additional fee. If you would like more information about this service, please contact a Customer Service Representative at any of our full service offices.

How do I add or change account beneficiaries?

You will need to sign a new signature card with the new beneficiaries listed. All account holders / owners must sign the new signature card in order for the new beneficiaries to be valid. If you have specific questions on how to do this, or about beneficiaries, please contact a Personal Banker at any of our full-service offices and someone will be happy to assist you.

Do you offer an account I can roll my 401k into?

Yes, American Bank offers several options for 401k rollovers; please contact a Personal Banker at any of our full-service offices to learn more.

Is there penalty for early withdrawal from a certificate?

Yes, there is an early withdrawal penalty from a certificate. The amount of the penalty is based on the term of the certificate. We waive the penalty if the certificate is an IRA, you are over 70 1/2 years of age and you are withdrawing to meet your Required Minimum Distribution. If you have questions on your certificate (either Certificate of Deposit (CD) or Individual Retirement Account (IRA)) and the possible penalties for early withdrawal, please contact a Personal Banker at any of our full-service offices and someone will be happy to assist you.

What happens if I deposit or write a check and it bounces?

If you deposit a check that bounces, the bank will remove the funds from your account and return the dishonored check to you. You will be charged a $10 fee at the time the check is returned. You will then have the option to re-deposit the check, attempt to cash it over the counter at the bank it was drawn on, or contact the person who issued you the check and request another form of payment. You may redeposit the check up to 3 times, however, you will be charged each the time the check is returned.

If you write a check and it bounces, we may, at our discretion, choose to pay the check for you as a courtesy and overdraw your account. You will be given notice by mail of the overdraft and agree to bring your account back to a positive balance in a timely manner. If we do not choose to overdraw your account, we will return the check to the person you made it out to. Whether we choose to pay the check or return it, a $30 fee will be assessed to your account.

How do I get a voided check to set up direct deposit?

If you have ordered checks for your account, you can simply write VOID across the front of one of those checks. If you did not order checks, or have not received them yet, we can print you a few at any of our full-service offices. However, it is important to note that not all businesses will accept these temporary checks to set up direct deposit so be sure to ask if this type of check will work for you and your employer.

Do you sell or cash savings bonds?

American Bank does not currently sell savings bonds at at any of its offices. Savings bonds are no longer issued in paper format. When purchasing a savings bond the Department of the Treasury will set up an online account for you so you can hold the bonds 'electronically.' Bonds that are held electronically are cashed through your online account. You set everything up directly through the Treasury Department to purchase bonds.

American Bank does cash paper bonds at all of its full-service offices. You will need to bring your driver's license with you when you come in to cash your bond(s).

What should I do if my account is compromised?

The first thing you should is contact a Customer Service Representative at American Bank and explain your situation to us so we know how to best proceed and protect the funds in your account. We will work with you and have you fill out any paperwork necessary to dispute debit card transactions, return forged checks, return unauthorized ACH items, etc. We may also recommend that you close your current account and open a new account with a new number.

What should I do if I misplace or lose my checkbook?

The first thing you should do is contact a Customer Service Representative at any of our full-service offices and let us know you've lost your checkbook. We will work with you to determine if it is necessary to place a hold on the checks that were lost and possibly close that account and open a new one for you to best protect your funds.

Can I view accounts that I am Power Of Attorney (POA) on in online banking?

This is an option that is available to any POAs, but you will need to make a request to see these accounts; they will not appear automatically as accounts on your online banking homepage.

Can one person close an account that has multiple owners / signers?

Yes, one person can close an account that has multiple owner and/or signers, provided there are no restrictions on the account. It only takes one account owner / signer to close an account. This does not apply to accounts that require two signatures for withdrawal, those accounts do require both account holders to sign to close the account. If you have questions on what you need to do with your account, contact a Customer Service Representative at any of our full-service offices.

Will my account be closed if I don't use them?

Generally speaking, no, American Bank does not close an account for inactivity. There is an exception to this - if your account has remained inactive for 5 years or more and we have not been able to reach you to determine that you know the funds are here, then we are required by the State's Abandoned Property Law to 'escheat' those funds to the State of Wisconsin for safekeeping. You are allowed to reclaim those funds through the State by proving they belong to you.

What accounts do I get tax forms for?

The bank issues several different tax forms. We issue a 1099 form to any individual we paid more than $10 in interest to during the year. We issue a 1099R to any individual with an Individual Retirement Account (IRA) who either made a contribution or withdrawal during the tax year. We issue a 1098 to customers who have their mortgage with us showing the amount of interest paid on the mortgage. All these forms need to be reported in the appropriate areas on your income tax returns. These forms are mailed by January 31 of the current year for the previous year. However, you can also access them from your online banking profile with American Bank as well. To do that, follow these instructions:

- Log-in to Online Banking

- From the Home screen click the account you want to get the appropriate form for

- Then click DOCUMENTS button

- On the next screen, choose the type of document you wish to get, the date range and click Submit

- A list of matching documents fitting the criteria will show up and you click the link to view each one

Do you offer trust accounts?

You may choose to title your accounts in the name of your trust, this has been become a very popular option. When you come into open an account like this at any of American Bank's offices, you will need to provide us the names of your current and successor trustees when titling your accounts this way. We will also need to bring the proper trust paperwork with you as well to assist us in opening the account.

Why am I receiving a dormancy letter?

American Bank is required by law to send a dormancy notice when there has not been any activity in your account (except for interest paid) in the last two and half years. By signing the dormancy notice and returning it to the bank, you allow us to keep your account 'active' and avoid the possibility that your account could be 'escheated' to the State of Wisconsin due to inactivity.

Business Questions

How can I open a business account?

Business deposit accounts can be opened at any of our full-service offices. To open an account, you can either walk into any of those locations or you can call and schedule an appointment with a personal banker.

You will need to have the Tax ID number of the business you are opening the account for, along with identification of the business. Proper identification can be provided with any of these documents:

- Articles of Incorporation

- Articles of Organization

- Partnership Agreement

- 501c3 Paperwork

- IRS Tax ID Confirmation

- Tax Returns

- Corporate Resolution

Not exactly sure what to bring?

Call one of our offices and speak to a personal banker on necessary paperwork needed to open an account for your business.

Do business accounts have monthly fees?

Our Small Business Checking Account and Regular Business Checking Account do have monthly fees associated with them. To avoid these monthly fees, you can maintain the minimum balance requirements and items limit, or have a loan relationship with the bank. Click on each type of account above for more details on the specific account.

Can I change the name on my business account?

If the type of business is changing or if you are obtaining a new tax ID number, you will be required to open a new business account with us. If the tax ID number is staying the same, and nature of the business is the same, we will need to see new business identification with the new name prior to changing it. The account number for your business will be able to remain the same.

Is there a fee for Business Online Banking and/or Business BillPay?

Currently, American Bank does not charge any fees for Business Online Banking.

Please refer to Fee Schedule for Business BillPay fees.